The world’s most important insurance conference

4 - 5 November 2025 | Business Design Centre, London

Attracting 2000+ insurance big hitters and next-gen disruptors from across the globe, Insurance Innovators Summit is the event reshaping insurance as we know it.

Forge ground-breaking partnerships, turn disruptive forces into opportunities and supercharge your innovation agenda.

2025 Conference Speakers

Alison Martin

David McMillan

Mark Bailie

Frank Eijsink

Dr Christine Theodorovics

Mark Hussein

Rowan Douglas

Yanna Winter

Richard Pash

Richard Pash joined Zurich in July 2016 as Director of UK Life Marketing. He became UK Marketing Director in 2017 and UK Chief Customer Officer in 2020. Richard leads the UK Customer Office, delivering Brand Marketing, Digital Marketing, Customer Insight and Experience, Customer Communication, and Events. He is responsible for marketing and customer activity for each of our business divisions and across the broader UK business. He is also a member of the Global Customer Office Leadership Team and a Vice President of the Institute of Customer Service.

Richard has a wealth of experience, as both Director of Marketing and Customer within market leading financial services, telecoms and ‘fast-moving consumer goods’ industries. Richard has achieved significant results through a strong focus on consumer needs, expertise in Digital Marketing, and leading strategic initiatives. He has broad experience in managing business units in companies such as Virgin Media, Vodafone and Mars.

Richard lives near Marlborough and studied at the University of Oxford where he achieved an MA in Chemistry.

Tim Mann

Liam Jones

Cassandra Vukorep

Who attends

Check out who you can expect to meet at this year’s insurance conference

Why sponsor

Thought leadership

Demonstrate your expertise and position yourselves as market leaders by delivering a keynote presentation, participating in a panel discussion or fireside chat alongside industry leaders.

Brand awareness

Ensure the prominence of your brand with senior leaders in the insurance world with branding opportunities across our venue, our social channels, and our matchmaking app.

Lead generation

Form lasting connections with experts and leaders from key industry players through our AI-driven matchmaking platform and 1-2-1 meetings, or by sponsoring a collaborative roundtable session.

Who sponsors

We are proud to partner with leading lights across the global insurance sector. If you provide solutions to insurers or insurtech ecosystem, this is your best opportunity to connect with 1500+ senior insurance professionals all under one roof.

![Guidewire-Guidewire & AWS - 10-AWS Sponsor Information [Upload your company logo]-2](https://insurance-innovators.com/wp-content/uploads/2024/04/Guidewire-Guidewire-AWS-10-AWS-Sponsor-Information-Upload-your-company-logo-2.png)

![FICO-13-Sponsor information [Upload your company logo]-1](https://insurance-innovators.com/wp-content/uploads/2021/09/FICO-13-Sponsor-information-Upload-your-company-logo-1-600x215.png)

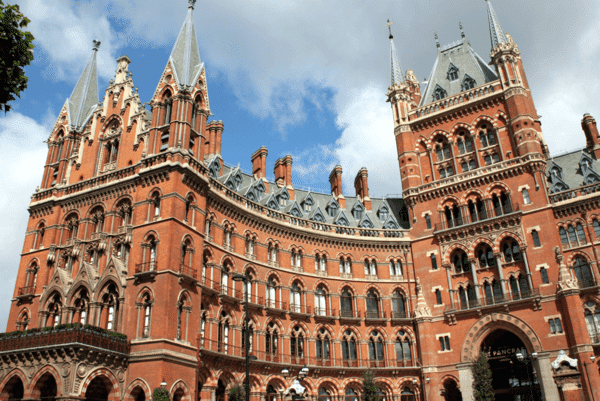

Experience London

Insurance Innovators Summit isn’t just about unbeatable insights and networking — it's your chance to explore the vibrant city of London. While you're here, discover the best sights, sounds, and flavours this world-class destination has to offer with our top recommendations.

Networking

Unlock unparalleled networking at Insurance Innovators Summit with AI-powered connections and personalised 1-to-1 meetings through our Networking app.

1-to-1 meetings

Pre-arrange private meetings with attendees who match your business needs. Our analytics-based matchmaking ensures you meet the right people, maximizing the value of your time at the Summit.

The MarketforceLive Networking App

Use our dedicated networking app to schedule meetings, connect with other attendees, and manage your Insurance Innovators Summit experience.

The Official After Party

Cap off your Summit experience with an unforgettable after party. It's the perfect opportunity to unwind and catch up with your peers and prospects. Good food, good drinks and good vibes are guaranteed!

#IISUMMIT25

2024 Conference Sponsors

We are proud to partner with leading lights across the global insurance sector. If you provide solutions to insurers or insurtech ecosystem, this is your best opportunity to connect with 1500+ senior insurance professionals all under one roof.

Platinum

Gold Sponsors

Silver Sponsors

Bronze Sponsors

Media Partners

CEO Forum - Navigating a changing insurance landscape

Customer Stage

Ecosystems

Transformation Stage

Data

Product & Price Stage

Product

Claims & Fraud Stage

The future of digital claims

Life & Wellness Stage

Customer Stage

Embedded insurance

Transformation Stage

An AI-powered organisation

Product & Price Stage

Pricing

Claims & Fraud Stage

Claims in turbulent times

Life & Wellness Stage

Customer Stage

IOT

Transformation Stage

Next-gen transformation

Product & Price Stage

Underwriting

Claims & Fraud Stage

Fraud

Life & Wellness Stage

Day 2

____

CEO Forum - The innovation-ready insurer

Customer Stage

Delighting the customer

Transformation Stage

The future of operations

Motor Stage

Connected motor

Commercial Stage

Innovation in commercial lines

Customer Stage

The future of distribution

Transformation Stage

The future of disruption

Motor Stage

Motor supply chain

Commercial Stage

Insuring the green economy

Trends Report 2025

The Insurance Innovators Trends Report 2025 is your guide to understanding last year’s pivotal developments and using them to inform your strategy for 2025