I N T E R V I E W

“The possibilities are endless” – FloodFlash’s vision for parametric insurance

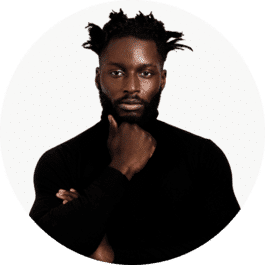

In conversation with Ola Jacob, Broker Success Manager, Floodflash

Published: 14 November 2022

By Isabella Chatterton-Daniels

Conference Producer

Do you think the parametric model is the best approach to build resilience against climate risk? What tangible benefits could we see as a result of this?

Parametric insurance is a great option for climate risks. Taking FloodFlash as an example, there are three core benefits: availability, flexibility and the fast claims experience. In terms of availability, parametric insurance reduces the number of variables in the underwriting equation. Rather than setting premiums based on potential losses, we calculate the insurance based on the payout amounts that the client requests. In that sense we know the value of any claim before it happens. That reduces underwriting uncertainty hugely, which we pass onto clients as more affordable premiums.

FloodFlash clients are in complete control of their cover.

Flexibility is another hallmark of parametric insurance. FloodFlash clients are in complete control of their cover. They chose the trigger depth for their policy, how much money they receive when flooding reaches that depth and where to place the sensor that measures flood depth. That flexibility means that clients can design policies that suit their business, resilience levels and budgets.

The final, and perhaps most important, benefit of parametric cover is the simplicity of the claims process. When flooding occurs, the sensor installed at the client’s property sends data to us over the wireless networks. We don’t need to visit the property relying on the sensor and supporting data to verify the claim. This is a game-changer in terms of the client experience. The claim is underway without them needing to report it, and in many cases we are paying the client within 48 hours of the flood. Our fastest claim ever took just 5 hours and 36 minutes. Fast claims like these reduces the claim value (through damp and mould setting in), business interruption and client stress in the process.

It’s worth noting that parametric covers are a great alternative, but we don’t see them replacing traditional insurance any time soon. In many cases clients are using a combination of parametric cover to protect cash flow and indemnity cover to protect the balance sheet. In short, the most resilient businesses do both!

With whom do you think insurers need to collaborate with to drive the predict and prevent model forward?

This is a tricky one. The big challenge is making clients aware of the benefits of increased resilience beyond the financial resilience that insurance offers. We are seeing many brokers transition from pure insurance specialists to client partners that can discuss more complete resilience packages. Discussing things outside of insurance is always difficult when clients are time poor and budget squeezed – as they have been lately with rising premiums at renewal.

We are seeing early signs of brokers taking a central role in bringing specialists together. When clients can draw on the experience of prediction, resilience and insurance specialists together they can design bespoke solutions that will make their businesses as resilient as possible. There’s a long way to go before we get there though.

How far do you think the rapid digitalization and move to straight through processing engendered by the covid-19 pandemic has changed consumer expectations in the insurance industry?

The biggest challenge posed by the pandemic is how insurers and brokers can communicate with clients remotely. This is more noticeable when launching a relatively new product. When our team is unable to visit a client’s site to discuss the risk in detail, they are under increasing pressure to communicate the nuances of the cover on the phone, zoom or email.

We’ve done a lot of combat this. We have produced more client-facing collateral and launched our latest service smart quote. This takes client characteristics to provide bespoke insights that support them while selecting their trigger depths and payout amounts. Whilst we are now back on the road and seeing more brokers and their clients, the innovations that we have carried out will pay dividends for many years to come.

What have you learned bringing such a new proposition to the market?

One of the most striking things that we learned during our 2019 launch was that parametric insurance is almost too simple. We heard the phrase “too good to be true” so many times that it turned from a compliment to a curse. Brokers that had been in the industry for longer felt that even more. They just didn’t believe that insurance could work in that way.

We heard the phrase “too good to be true” so many times that it turned from a compliment to a curse.

The best way to combat this reaction is using real client cases and testimonials. When clients see that businesses like theirs have been paid within 48 hours of a flood, FloodFlash changes from a wild idea to a real benefit.

The second issue that we encountered is one that is common for many MGAs. There is a strong feeling amongst brokers and clients that MGAs are at risk of losing their capacity at any given point. For FloodFlash a common response is that any floods and we will no longer be able to operate. Of course, we have extensive processes to make sure that doesn’t happen.

Once again, the proof is in the pudding. We’ve now paid clients in 5 storm events since our commercial launch and are still going strong. This is thanks to our best-in-class flood modelling and underwriting models, as well as the fantastic relationship we have with our insurers at Munich Re. When Munich Re Ventures (the investment arm of Munich Re) invested in FloodFlash as part of our Series A earlier this year, the relationship was strengthened further – giving our distribution no doubt as to our future capacity.

What areas do you see parametric insurance moving into in the future?

The possibilities are endless. If you can measure it then parametric insurance can be used to provide financial resilience. There are great examples emerging to cover everything from server downtime to downturns in social media reputation. We’re really excited to be a part of the movement and to see how far it goes.

Follow us on:

Ola Jacobs

Broker Success Manager, Floodflash

Ola has enjoyed over ten years working in the London Market Insurance Sector on UK Retail, Product Recall, Terrorism and Onshore Energy. Since joining FloodFlash, Ola has formed a key part of the team responsible for bringing their award-winning flood tech insurance to clients around the UK.

Want to hear more from Ola? Join him at Insurance Innovators: Fraud & Claims being held at Guoman Tower Hotel, London on 7 March 2023, where he will be joining the panel discussion, ‘Grasping the potential: collaboration and innovation in fraud and claims’.

Stay current with Insurance Innovators

Subscribe to our newsletter to receive news, insights and special offers.